CORPORATE GOVERNANCE SYSTEM

CORPORATE GOVERNANCE MODEL AND PRACTICE

Moscow Exchange is one of Russia’s largest public companies. The Bank of Russia, which acts as regulator of the financial market, is one of the Exchange’s shareholders. The Exchange is also a market infrastructure operator that establishes rules for other issuers. Because of all these factors, the Exchange must adhere to the highest corporate governance standards. Continued development of the corporate governance system is aimed primarily at improving the Exchange’s effectiveness and competitiveness, and maintaining a positive perception of the Exchange’s corporate governance system among shareholders, investors and the broader business community.

The Exchange continuously evaluates and responds to developments in corporate legislation and corporate governance practices in Russia and internationally. It complies with Federal Law No. 325-FZ “On Organised Trading” dated 21 November 2011, which outlines the corporate governance requirements for the organiser of trading; the principles and recommendations prescribed in the Corporate Governance Code of the Bank of Russia; the requirements of the Listing Rules; the G20/OECD corporate governance principles; international standards and principles relating to corporate social responsibility and sustainable development.

Shares of the Exchange are included in the first level quotation list. To ensure that the Exchange’s activities and documents fully comply with the corporate governance requirements set out in the Listing Rules and with the Bank of Russia’s Corporate Governance Code, the following measures were taken in 2022:

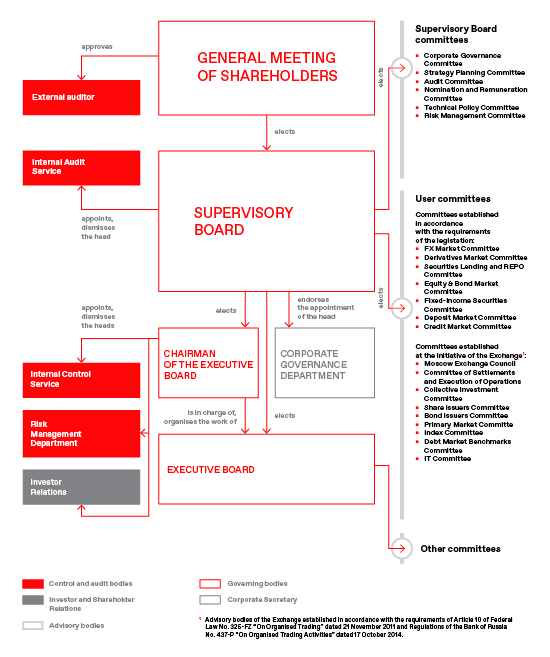

- five independent directors were elected to the Supervisory Board, which consists of 12 members;

- all independent directors meet the independence criteria set by the Listing Rules;

- independent members of the Supervisory Board are included the Audit Committee and the Nomination and Remuneration Committee.

elects

GENERAL MEETING OF SHAREHOLDERS

The General Meeting of Shareholders is the supreme governing body of the Exchange. General Meetings of Shareholders adopt resolutions on strategic issues. The scope of issues within the terms of reference of General Meetings of Shareholders is determined by Federal Law No. 208-FZ “On Joint-Stock Companies” dated 26 December 1995 and the Exchange Charter. The Annual General Meeting of Shareholders (AGM) of the Exchange was held in absentia on 28 April 2022. In addition to reviewing mandatory and routine issues, the AGM was supposed to vote for resolutions on approval of new versions of the Charter, Regulation on the Supervisory Board, Regulation on Remuneration and Compensation for Members of the Supervisory Board, Regulation on the Executive Board and to consider the reduction of the number of members of the Supervisory Board’s from 12 to 9. However, based on the results of counting the votes by the counting commission, the AGM was declared invalid as there was no quorum needed to adopt resolutions. Pursuant to Federal Law No. 208-FZ “On Joint-Stock Companies” dated 26 December 1995, in the absence of a quorum for holding an annual general meeting of shareholders, a repeated general meeting of shareholders must be held with the same agenda, which is legally competent (has a quorum) if shareholders holding an aggregate of at least 30 per cent of the voting shares in the company take part in it. The repeated meeting of shareholders, at which favourable resolutions were passed on all the matters submitted for consideration, was held on 6 June 2022.

SUPERVISORY BOARD

Role of the Supervisory Board

The Supervisory Board is a key element of the corporate governance system, with overall responsibility for the activities of the Exchange. The Supervisory Board is accountable to the General Meeting of Shareholders: members of the Supervisory Board are elected by the General Meeting of Shareholders, and their powers may be terminated at any time by the General Meeting of Shareholders.

The terms of reference of the Supervisory Board are established in the Charter and are clearly separated from those of the executive bodies that manage the day-to-day activities of the Exchange. In particular, the Supervisory Board:

- determines the vision, mission and strategy of the Exchange;

- is responsible for strategic oversight and long-term sustainable development of the Exchange;

- establishes strategic goals and key performance indicators of the Exchange’s activities.

When developing the Exchange’s strategy, the Supervisory Board takes into account shareholders’ vision for the development of the Exchange. The Supervisory Board considers queries and requests from shareholders and investors and, if necessary, gives appropriate instructions to the management.

The work schedule approved by the Supervisory Board for the calendar year includes the main activities of the Exchange, which are correlated with the strategic planning cycle and ongoing business cycles of the Exchange. When preparing the work schedule, proposals of members of the Supervisory Board and the management on priority issues are taken into account.

Information on the activities of the Supervisory Board, including meetings held and work of its committees, is disclosed in the Annual Report of the Exchange.

Structure of the Supervisory Board

The Supervisory Board is composed of directors who have the experience and professional skills required to implement the Exchange’s strategy.

In accordance with the Exchange’s Charter, the number of members of the Supervisory Board is set by the resolution of the General Meeting of Shareholders. Currently, the Supervisory Board of the Exchange is comprised of 12 members.

The Supervisory Board is managed and administered by the Chairman of the Supervisory Board.

The Chairman is elected/re-elected by the members of the Supervisory Board from among the Board membership by a majority vote.

The following committees were formed under the Supervisory Board in 2022 for preliminary consideration of key issues and preparation of recommendations for the Supervisory Board to adopt respective resolutions:

- Strategy Planning Committee;

- Audit Committee;

- Nomination and Remuneration Committee;

- Technical Policy Committee;

- Risk Management Committee;

- Corporate Governance Committee.

Members of the committees are selected annually from among the members of the Supervisory Board of the Exchange. Three of the five Supervisory Board committees (Audit Committee, Nomination and Remuneration Committee and Technical Policy Committee) are headed by independent directors and include, but are not limited to, independent directors.

Other experts in the relevant professional areas are also invited to participate in the Technical Policy Committee and Corporate Governance Committee.

Members of the Supervisory Board of the Exchange are experts in financial market infrastructure, international organised trading, IT in the financial sector, operational and financial risk management and financial reporting. They also have skills in personnel policy and modern approaches to incentivising top managers.

At the 2022 repeated Annual General Meeting of Shareholders, four independent members were elected into the Supervisory Board who met all the independence criteria set forth in the Listing Rules (no relationship with the Exchange, its significant shareholders, significant competitors or counterparties, as well as no relationship with the government), and eight non-executive members were elected. At the first meeting, one additional member was qualified as an independent director, notwithstanding existing nominal relationship with a significant shareholder.

There are no conflicts of interests of Supervisory Board members and Executive Board members, including those relating to the participation of the said persons in the governing bodies of the Exchange’s competitors.

Activities of the Supervisory Board in 2022

From 1 January 2022 to 31 December 2022, the Supervisory Board held 23 meetings, including seven in-person meetings.

Ten meetings of the Supervisory Board were held prior to and 13 meetings after the Annual General Meeting of Shareholders on 6 June 2022.

The cumulative attendance rate of the Supervisory Board members at the Supervisory Board meetings exceeded 92%.

In 2022, the cumulative length of service of all its members was 48 years.

In 2022, the Supervisory Board considered issues relating to the performance of its main functions, including:

- strategy issues:

- implementation of strategic areas overseen by the Supervisory Board;

- approval of the Tax Strategy of the Moscow Exchange Group.

- personnel issues:

- approval of the Remuneration and Reimbursement (Compensation) Policy for Members of the Supervisory Board, the Remuneration and Compensation Policy for Members of the Executive Bodies, the Employee Remuneration Policy.

- business development issues:

- review of fees on the equity and bond market, deposit market, derivatives market; trading fees on the FX market, and listing fees;

- approval of the new version of the Regulation on Fees for Participation in Trading on the Equity and Bond Market and Deposit and Credit Markets.

- key documents of the Exchange:

- Rules of Organised Trading of Moscow Exchange on Various Markets, Listing Rules, Rules of Admission to Organised Trading of Moscow Exchange on all markets.

- risk management issues:

- approval of the Strategic Risk Management Policy, the Operational Risk Management Policy, the Financial Risk Management Policy, the Regulatory Risk Management Policy, the Legal Risk Management Policy and the Business Reputation Loss Risk Management Policy;

- endorsement of the Rules for Managing Risks Associated with Activities of a Trade Organiser and Digital Financial Asset Exchange Operator;

- approval of the Rules for Managing Risks Associated with Activities of a Financial Platform Operator.

Appointment, induction and training of the Supervisory Board members

In accordance with the Federal Law “On Joint-Stock Companies” and the Exchange’s Charter, shareholders holding in aggregate at least 2% of the voting shares in the Exchange may nominate candidates to the Supervisory Board of the Exchange, the number of which cannot exceed the number of members of the Supervisory Board of the Exchange, no later than 60 days after the end of each fiscal year.

As of 2 March 2022, the Exchange had received proposals for the nomination of two candidates to the Supervisory Board to be elected at the Annual General Meeting of Shareholders in 2022; both of them were included in the list for voting at the General Meeting of Shareholders.

In accordance with the Federal Law “On Joint-Stock Companies”, the Supervisory Board is entitled to nominate candidates for the Exchange’s Supervisory Board, apart from those nominated by the shareholders, at its own discretion. Succession planning and provision for the required competencies on the Supervisory Board are considered to be best practice. The Nomination and Remuneration Committee, taking into account consultations with the members of the Supervisory Board and significant shareholders, recommended that the Supervisory Board include 12 candidates most suitable for election to the Supervisory Board for the

As part of the induction of newly elected directors, an onboarding programme for new members of the Supervisory Board of the Exchange is being implemented, which provides for familiarisation with the main internal documents of the Exchange, resolutions of the meeting of shareholders and the Supervisory Board, as well as for holding individual meetings with the Chairman of the Supervisory Board, Chairman of the Executive Board, Corporate Secretary and key managers of the Group.

ACTIVITIES OF THE SUPERVISORY BOARD COMMITTEES IN 2022

Committees | Over the period | Over the period | Total | ||

|---|---|---|---|---|---|

in 2022 | |||||

in-person | remote | in-person | remote | ||

Strategy Planning Committee | 1 | 0 | 2 | 0 | 3 |

Audit Committee | 4 | 0 | 5 | 2 | 11 |

Nomination and Remuneration Committee | 7 | 1 | 5 | 0 | 13 |

Risk Management Committee | 3 | 1 | 3 | 3 | 10 |

Technical Policy Committee | 1 | 0 | 5 | 0 | 6 |

Corporate Governance Committee | 0 | 0 | 0 | 0 | 0 |

Audit Committee

The primary purpose of the Audit Committee is to ensure the Supervisory Board is effective in addressing issues relating to the control of financial and economic activities.

In 2022, 54 issues were considered at meetings of the Audit Committee.

The main issues considered by the Committee in 2022, on which recommendations were given to the Supervisory Board, related to the assessment of the performance of the Group’s external auditor, review of the consolidated financial statements and reports of the Internal Audit Service.

The Audit Committee considered issues related to the principles of organisation of the internal control system, preliminary results of the audit of Group companies, implementation of the consolidated business plan, and the Group’s Corporate Governance Policy.

The Committee considered and recommended to the Supervisory Board to adopt the Internal Audit Policy (Standard), Regulation on Identifying and Preventing Conflicts of Interest by Moscow Exchange while Acting as Trading Organiser and Financial Platform Operator, and Internal Control System Principles.

In 2022, the Supervisory Board recommended that the General Meeting of Shareholders select TsATR LLC (Ernst and Young LLC before renaming in 2022) as external auditor upon the recommendation of the Audit Committee, and the corresponding resolution was adopted at the Annual General Meeting.

Nomination and Remuneration Committee

The primary purpose of the Nomination and Remuneration Committee is to support the effective work of the Supervisory Board in addressing issues relating to the activities of the Exchange, as well as other companies directly or indirectly controlled by the Exchange, in the field of nomination and remuneration of members of supervisory boards, executive bodies and other key executives and members of revision commissions.

In 2022, 42 issues were considered by the Nomination and Remuneration Committee of the Supervisory Board.

The main issues considered by the Committee in 2022, on which relevant recommendations were given to the Supervisory Board, related to planning of compositions of supervisory boards of the Exchange, National Settlement Depository (NSD), and Central Counterparty National Clearing Centre (CCP NCC), external assessment of activities of the Supervisory Board and Committees of the Exchange, nomination of candidates for the Supervisory Board, giving recommendations on the determination and assessment of achievement of corporate KPIs of the Group and individual KPIs of members of executive bodies and the Director of the Corporate Governance Department of the Exchange, the option program for management, Supervisory Board and management succession program, the financial protection program for the Moscow Exchange Group management in the event of sanction risk materialising, the Employee Reimbursement Policy of the Exchange, and extension of powers of the Executive Board members.

Strategy Planning Committee

The primary purpose of the Strategy Planning Committee is to improve the performance of the Exchange and companies directly or indirectly controlled by the Exchange in the long and medium term.

In 2022, 12 issues were considered at the meetings of the Strategy Planning Committee of the Supervisory Board.

The main issues considered by the Committee in 2022, on which recommendations were given to the Supervisory Board, related to recommendations to adjust the Group Strategy, technology sanction risk management, feasibility of the Exchange’s participation in other companies, and consolidated business planning issues.

Risk Management Committee

The main task of the Risk Management Committee is to foster the improvement of the risk management system of the Exchange and Group companies in order to enhance the reliability and efficiency of the activities of the Exchange.

In 2022, 26 issues were considered by the Risk Management Committee of the Supervisory Board.

The main issues considered by the Committee in 2022, on which relevant recommendations were given to the Supervisory Board, related to the review of the results of external assessment of the central counterparty’s control system and the maturity level of information security within the Group, approval of the Asset and Liability Management policies of the Group, as well as information security and revision of the Rules and Policies for managing various types of risks at the Group, including business continuity, operational, non-financial, non-economic, legal and IT risks. At the meetings of the Committee, special attention was paid to the follow-up of the Committee’s previous recommendations.

Technical Policy Committee

The primary purpose of the Technical Policy Committee is to develop and strengthen effectiveness of the Group’s activities through preparation of recommendations and expert opinions to the Supervisory Board of the Exchange, boards of directors (supervisory boards) of Group companies and their committees, executive bodies of the Exchange and Group companies in respect of technical policy and development of IT and software of the Group.

In 2022, 25 issues were considered by the Technical Policy Committee of the Supervisory Board.

The issues considered by the Committee in 2022, on which recommendations were given to the Supervisory Board, related to the implementation of the IT strategy of the Group and its technical policy, assessment of the maturity level of information security of the Group, the Group’s technology landscape change, and development of the project of digital financial assets automation.

Corporate Governance Committee

The Supervisory Board’s resolution to form a new Corporate Governance Committee was adopted at the end of December 2022, due to which no meetings of the Committee were held during the year.

ASSESSMENT OF SUPERVISORY BOARD AND COMMITTEE PERFORMANCE

Assumptions and Grounds for the Assessment

In accordance with the recommendations of the Corporate Governance Code and best international practices, Moscow Exchange assesses the performance of the Supervisory Board on an annual basis. In accordance with the internal Regulation, the Nomination and Remuneration Committee of the Supervisory Board regularly (once in three years) engages external consultants for an independent assessment.

In 2022, the external assessment was performed by Ward Howell, an independent consultant selected by the Supervisory Board through a bid process. The selection criteria, alongside with the cost of services, included availability of similar project experience, academic and practical expertise in corporate governance with the consultant, and the experience and professional level of the project team. In addition, Ward Howell already conducted an external assessment of the Supervisory Board of Moscow Exchange in 2019, which ensured continuity of the assessment methodology.

Assessment Goals and Objectives

The assessment goals include monitoring of the dynamics of changes in the activities of the Supervisory Board and the committees, as well as identification of areas for improvement of performance of the Supervisory Board and its individual members. In addition, a particular focus of the 2022 assessment was the vision of the Group’s corporate governance model.

To achieve these goals, the following objectives were addressed:

- the role and functions of the Supervisory Board and the committees in the Moscow Exchange’s corporate governance system were assessed;

- the composition of the Supervisory Board and the committees in terms of its balance and the effectiveness of the formation process was analysed;

- the priority areas for the Supervisory Board and the Committees were identified;

- the effectiveness of processes and procedures of the Supervisory Board and the committees was assessed;

- the effectiveness of interaction between Moscow Exchange and its subsidiaries was assessed;

- the dynamics of the meetings of the Supervisory Board and the committees was assessed;

- the contribution and effectiveness of the Chairman of the Supervisory Board, the chairmen of the committees and the Corporate Secretary were assessed;

- the level of involvement and preparation for Supervisory Board meetings was assessed on an individual basis;

- recommendations to improve the activities of the Supervisory Board and its collegiate bodies, to ensure optimal composition, to plan succession and to implement training and development measures were prepared.

Assessment Methodology

To collect necessary information and obtain as objective results as possible, the consultants used several tools:

- internal document analysis;

- analysis of video records of the meetings pf the Supervisory Board and the committees;

- questionnaire survey of the Supervisory Board members and management representatives;

- interviews with members of the Supervisory Board, Moscow Exchange management representatives, and representatives of NCC Supervisory Board and management;

- individual assessment of the Supervisory Board members using the “360-degree” method.

The Supervisory Boards members and management representatives of Moscow Exchange and NCC took an active part in the assessment. The main assessment tool, the structured interview, covered 32 persons (94% of the envisaged assessment participants). The external consultant noted the high quality of the feedback and the openness of the participants during the interviews. For the Supervisory Board members and management of Moscow Exchange, participation in the questionnaire survey was also envisaged. More than half of all Moscow Exchange management representatives and half of all directors of the Board took part in the survey. The participation of NCC representatives was only envisaged during the interview phase (100% of the participants were interviewed). Involvement of participants from different groups allowed for the widest and most objective assessment.

Assessment Results

According to the results of the 2022 assessment, the Supervisory Board has significantly improved its performance in certain aspects of its work that were highlighted as areas for development during the previous external assessment in 2019, namely the quality of the Supervisory Board’s interaction with the management; the quality of interaction with the regulator, the Central Bank; strengthened competencies in IT, digital product development, operational risks; reduced agenda overload and fewer formal items on the agenda.

Among the strengths of the Supervisory Board, the following aspects particularly stood out:

- Effective dialogue between the Supervisory Board and the management: clear separation of powers, minimal interference by the Supervisory Board in operational management, increased trust, increased management autonomy, mutual support and high speed of interaction.

- Professional and diverse composition : The Supervisory Board brings together professionals with diverse profiles (entrepreneurial, functional, country-specific) and international expertise (in the stock exchange industry, digital products, finance), which enables the Supervisory Board to address issues in a comprehensive manner and engage in meaningful discussions from different perspectives. The Supervisory Board There also demonstrates gender and age diversity.

- The leadership style of the Chairman of the Supervisory Board: the Chairman is deeply involved in the Board operation, supporting directors and management, effectively managing relationships with key stakeholders and representing the Company externally.

- The Corporate Secretary and support from the Corporate Governance Department: the Corporate Secretary promptly implements best corporate governance practices and ensures the effective operation and support of the Supervisory Board.

FURTHER DEVELOPMENT OF CORPORATE GOVERNANCE

The main focus of the Supervisory Board in developing the Group’s corporate governance system is to create a corporate governance model for all Group companies shared by all stakeholders, including through the establishment of competence centres in Group companies, as well as to update the corporate governance risk management system in the companies included in the Group as a result of the mergers and acquisitions being implemented.

In terms of operational efficiency of the Supervisory Board, the focus will be on the dynamics of online meetings, which were widespread during the pandemic, and the emerging demand for in-person meetings with the attendance of the members of governing bodies.

The strategic vector of the Supervisory Board’s work seems important: minimising formal and technical items on the agenda, prioritising the Group’s strategic development, especially addressing strategic developments within the personal finance platform Finuslugi project.

Additional attention will be paid to creating a balance between the advisory and supervisory functions of the Supervisory Board in relation to management, both during meetings and ongoing interactions.

The essential objective is to reshape the succession programme for the Supervisory Board and management in the light of the lessons learned in 2022, for it to be able to ensure the successful implementation of the new strategy that the Supervisory Board has been preparing in

MOSCOW EXCHANGE’S СORPORATE GOVERNANCE CODE

The current version of the Exchange’s Corporate Governance Code was approved by the Supervisory Board in October 2019.

The Code complies with Russian legislation and was developed taking into account principles and recommendations of the Bank of Russia’s Corporate Governance Code, OECD’s Corporate Governance Principles, and other principles of corporate governance recommended by recognised international organisations; it complements the Exchange’s corporate governance system with procedures that comply with high standards of corporate governance.

The main purpose of the Exchange’s Code is to describe the corporate governance system currently applied on the Exchange to protect the rights and interests of its shareholders, enhance the business efficiency and improve the transparency and attractiveness of the Exchange for shareholders and consumers.

The Exchange’s Code describes the system, principles and practices of corporate governance of the Company, risk management and internal control. It provides for principles designed to ensure the protection of legitimate rights and interests of shareholders and the equal treatment of all shareholders when they exercise their rights. Additionally, the Code contains the Exchange’s corporate social responsibility goals and principles, the principles of interaction with shareholders, service users and other stakeholders, and the principles of corporate governance at Group companies.

A distinctive feature of the document is that it provides the background and mechanisms for the further improvement of the corporate governance system of the Exchange, as well as that it contains development plans for the implementation of corporate governance principles. This sets not a declarative but a practical tone for the Code and allows the Exchange to continue reforming and improving corporate governance.

METHODOLOGY FOR ASSESSING COMPLIANCE WITH THE PRINCIPLES OF THE BANK OF RUSSIA’S CORPORATE GOVERNANCE CODE

The recommendations of the Bank of Russia were applied as the methodology used by the Exchange to assess compliance with the corporate management principles set out in the Bank of Russia’s Corporate Governance Code.

The assessment looked at, among other things, compliance of the Exchange’s corporate governance practices and internal procedures with the principles and recommendations of the Bank of Russia’s Corporate Governance Code.

The results of the assessment are contained in the Report on Compliance with the Principles and Recommendations of the Corporate Governance Code, which is a part of this Annual Report.

Over the latest years, the Exchange has been working to bring its corporate management practices in line with the Bank of Russia’s Corporate Governance Code. An annual analysis of the results of the corporate governance assessment shows an increasing trend in the number of principles and recommendations observed.

INFORMATION POLICY

The Exchange strives to ensure that its activities are as transparent as possible for shareholders, investors and other stakeholders. To achieve these goals, the Exchange has adopted and has been implementing the Information Policy. The Information Policy is a body of rules that the Exchange (including members of its governing bodies, officials and employees) adheres to when disclosing information and/or providing information to shareholders and other stakeholders.

The information policy provides additional opportunities for stakeholders to exercise their rights and interests and is also aimed at improving the Exchange’s information interaction with all stakeholders.

DIRECTOR’S LIABILITY INSURANCE

The liability of the Exchange’s directors and officers (including independent directors), as members of the Exchange’s governing bodies is insured on annual basis. The purpose of this insurance is to provide compensation for potential damages caused by unintended negligent actions (or by their inaction) on the part of the insured individuals in the performance of their administrative activities.

Under the insurance contract concluded in 2022, the insurance premium is USD 520,000, and the insured amount is USD 50 mln (the total additional insured amount for independent directors is USD 5 mln). The insurer is Ingosstrakh.

The terms and conditions of the insurance contract, including the insurance coverage, are consistent with the best global insurance practices.

EXTERNAL AUDITOR

Full company name: TsATR (CENTRE FOR AUDIT TECHNOLOGIES AND SOLUTIONS — AUDIT SERVICES) LIMITED LIABILITY COMPANY

INN (TAXPAYER IDENTIFICATION NUMBER): 7709383532.

OGRN (PRIMARY STATE REGISTRATION NUMBER): 1027739707203.

ORNZ (PRINCIPAL NUMBER OF REGISTRATION ENTRY): 12006020327.

Location of the auditing organisation: 77 Sadovnicheskaya nab., bld 1, Moscow 115035, Russian Federation.

Full name of the self-regulatory organisation of auditors, of which the auditor is a member: Self-regulated organisation of auditors Association Sodruzhestvo.

Locations of the self-regulatory organisation of auditors, of which the auditor is a member: 21 Michurinsky pr., bld 4, Moscow 119192, Russian Federation.

The fee for the audit of the annual accounting (financial) statements of Moscow Exchange and of the consolidated statements of Moscow Exchange Group for 2022, as well as the review of the consolidated statements for 6M 2022 was RUB 18,780,000, including VAT.

External Auditor Selection Procedure

Moscow Exchange selects its auditors every three years, as stipulated by the Regulation on the Auditor Selection Committee. The number of audit years by one organisation normally does not exceed six years, or two consecutive auditor selection periods. The best candidate is chosen by the Auditor Selection Committee.

The auditor selection process is based on a review of technical and price characteristics of the bids and the selection of those providing the best terms for the audit of the financial (accounting) statements of Moscow Exchange and Group companies.

Based on its review of the bids, the Auditor Selection Committee determines the winning bid and recommends the candidate to the Supervisory Board’s Audit Committee. In turn, the Audit Committee recommends that the Supervisory Board should propose to the General Meeting of Shareholders of the Exchange to approve the candidate as the auditor. The final decision on auditor selection is made by the Annual General Meeting of Shareholders.

REMUNERATION FOR MEMBERS OF THE SUPERVISORY BOARD

The Exchange’s remuneration system for Supervisory Board members is set by the Policy for Remuneration and Reimbursement of Expenses (Compensations) (the “Policy”) and by the latest version of the Regulation on Remuneration and Compensation (the “Regulation”) approved in the latest version by the Annual General Meeting of Shareholders in 2022.

The Nomination and Remuneration Committee actively participates in improvement of the remuneration system for Supervisory Board members, taking into account corporate governance best practice and the experience of other public companies and international exchanges. The Policy and the Regulation apply only to members of Moscow Exchange Supervisory Board.

According to the Policy, remuneration paid to Supervisory Board members shall be sufficient to attract, retain and properly motivate individuals with the skills and qualifications necessary to work effectively on the Supervisory Board.

The Nomination and Remuneration Committee provides recommendations on remuneration of Supervisory Board members on the basis of an expert assessment of remuneration paid by Russian companies with similar capitalisation and competitors of the Exchange.

The Policy and Regulation govern all types of payments, benefits, and privileges provided to Supervisory Board members and contain no other forms of short-term or long-term incentives of Supervisory Board members.

In order to implement the principle of independent decision-making, the remuneration of Supervisory Board members is not linked to the performance of the Exchange or the value of the Exchange shares and does not include stock option programs. Supervisory Board members enjoy no pension contributions, insurance programs (apart from the Supervisory Board member liability insurance and the conventional insurance associated with travelling to perform duties as a director or to participate in Supervisory Board activities), investment programs, or other benefits or privileges, unless specified in the Policy and Regulation. The Exchange does not provide loans to Supervisory Board members and does not enter into civil law contracts with them for the provision of services to the Exchange, including on non-market terms.

Remuneration for performing the Supervisory Board member duties shall not be paid to government officials, employees of the Bank of Russia, employees and managers of the Exchange or its subsidiaries.

Remuneration of directors for performing the duties of Supervisory Board members comprises basic and supplementary components.

The level of basic remuneration of a member of the Supervisory Board depends on whether such member is independent or not, and:

- for an independent member of the Supervisory Board, amounts to RUB 9 mln;

- for a non-independent member of the Supervisory Board, amounts to RUB 6.5 mln.

The following differentiated supplementary remuneration is paid to Supervisory Board members for performance of additional duties, requiring extra time and effort, of Chairman of the Supervisory Board, Deputy Chairman of the Supervisory Board, Chairman of a Supervisory Board Committee, or member of a Supervisory Board Committee:

- for the Chairman of the Supervisory Board, RUB 11 mln;

- for the Deputy Chairman of the Supervisory Board, RUB 4 mln;

- for the Chairman of a Supervisory Board Committee, RUB 3.75 mln;

- for a member of a Supervisory Board Committee, RUB 1.5 mln.

In order to ensure remuneration of Supervisory Board members corresponds to changing market demands, until the next cycle of remuneration level review, the Regulation provides for adjustment of the level of remuneration of Supervisory Board members in line with the consumer price index at the end of the year in which the corresponding composition of the Supervisory Board was elected, and accrued starting from 1 January 2022.

The basic and additional remuneration of a Supervisory Board member may be reduced by 50% if the Supervisory Board member has attended less than 75% of the meetings of the Supervisory Board or committees in person, respectively. If a member of the Supervisory Board took part in 1/3 or less of the total number of meetings of the Supervisory Board or its committees or in 1/4 or less of in-person meetings of the Supervisory Board or its committees, the respective part of remuneration is not paid.

Apart from the remuneration for work on the Supervisory Board and Supervisory Board Committees, members of the Supervisory Board are reimbursed for travel expenses relating to participation in in-person meetings of the Supervisory Board or its Committees, General Meetings of Shareholders, as well as events attended while performing duties of Supervisory Board members.

The total amount of remuneration paid to the members of the Supervisory Board in 2022 was RUB 185,614 thousand.

EXECUTIVE BOARD AND CHAIRMAN OF THE EXECUTIVE BOARD

The current activities of the Exchange are managed by the Chairman of the Executive Board who is the sole executive body and by the Executive Board, which is the collegial executive body of the Exchange.

The Executive Board is headed by the Chairman who manages its activities.

REMUNERATION OF EXCHANGE BOARD MEMBERS

In 2022, the Supervisory Board approved the new Remuneration and Compensation Policy for Members of the Executive Bodies, regulating the remuneration of members of the Exchange’s executive bodies. The Policy sets out principles and approaches for remuneration, and establishes procedures for determining remuneration levels and types of payments, incentives and privileges provided to members of the executive bodies.

The Policy is based on the following key principles:

- Involvement and retention of a professional and effective team consisting of members of the executive bodies able to implement the Exchange’s strategy and other priorities and increase shareholder value;

- Competitive remuneration at a level sufficient to engage, motivate and retain competent and qualified Executive Board members;

- Maintaining an optimal balance between the Exchange’s business performance and the personal contribution of an Executive Board member in determining remuneration levels.

Executive Board members’ remuneration consists of a fixed salary and a variable component. The variable component comprises a significant portion of annual remuneration, and includes short- and long-term components. Short-term variable remuneration takes the form of an annual bonus based on the Exchange’s results and the individual contribution of the Executive Board member to those results. Long-term variable remuneration is shares-based and is established by the Long-Term Incentive Programme.

The short-term variable component is determined by an annual approval of key performance indicators including corporate and individual key efficiency indicators. From 2021, corporate indicators have been having more impact on the size of the bonus for Executive Board members: the ratio of corporate and individual indicators was 40:60 before 2021, it was set at 50:50 in 2021. In 2022, it was decided that for all members of the executive bodies the corporate targets will be individual targets, i.e. the corporate targets are 100%. For the Chairman of the Executive Board, this practice applies from 2020 onwards.

To promote personal responsibility, the Supervisory Board applies a delayed bonus plan taking into account the contribution of Executive Board members to the Exchange’s financial and other results, including the possibility of reducing or cancelling part of the delayed bonus if no positive results are obtained in the relevant area. Payment of 60% of the approved bonus amount for 2022 will be made in 2023, and 40% will be paid with a delay in equal portions within one and two calendar years (20% within one calendar year, and 20% within two calendar years) based on the relevant decisions of the Exchange’s Supervisory Board. This procedure makes it possible to account for risks created by decisions made by Executive Board members.

The stock-based Long-Term Incentive Programme, as approved by the Supervisory Board, is designed to boost Executive Board members’ motivation and responsibility, align their interests with those of shareholders and connect remuneration with long-term performance results. From 2 July 2020, a new programme has been in place, under which the right to obtain shares becomes effective in stages: over periods of three, four and five years after the programme start (i.e. in 2023, 2024 and 2025), provided that the contracts of the members remain in force and the established key efficiency indicator under the Programme is met.

Compensation paid in the event of early termination of the authority of a member of the Executive Board (following a Supervisory Board decision on terminating a contract), and assuming no unethical practices on the part of the member, is capped at the amount of the fixed annual bonus component. If a contract is terminated for other reasons, compensation is paid only in cases and amounts provided for by the Labour Code of the Russian Federation.

Specific remuneration due to executive body members, conditions and procedure for paying such remuneration, as well as conditions for early termination of agreements, including discharge allowances, compensations and other payments in any form exceeding those established by law, and conditions for their provision are considered and approved by the Supervisory Board based on recommendations made by the Assignment and Remuneration Committee, which reports to the Supervisory Board.

The Supervisory Board, supported by the Assignment and Remuneration Committee, ensures oversight of implementation of the Remuneration Policy, and can amend it as necessary.

Total remuneration due to a member of the Board, including the ratio of the remuneration components, is assessed by the Assignment and Remuneration Committee to ensure compliance with remuneration levels at comparable companies, based on a remuneration study from a leading consulting company.

Executive Board members are not paid for their work in management bodies of other Group companies.

The Exchange does not lend to members of management bodies and does not enter into civil law contracts with them for the provision of services to the Exchange, including any contracts on non-market terms.

The total amount of remuneration including salary and bonuses, paid to the members of the Executive Board in 2022 was RUB 361,349 thousand.

INTERNAL CONTROL SYSTEM

MOEX’s internal control system ensures that the Exchange’s licensed activities are conducted in accordance with Russian legislation and regulation, the rules of organised trading, and the Exchange’s own constituent and internal documents.

Internal control activities aim to identify, analyse, assess and monitor the risk of loss and/or other adverse consequences of both MOEX’s operational activities and measures taken by the Bank of Russian and other regulatory bodies (“compliance risk”), and to manage any such risks.

Within this framework, the Exchange’s internal control system is based on the COSO concept and utilizes a Three Lines of Defence model, which distributes risk management and internal control obligations among MOEX’s governing bodies, control and coordination units, and the internal audit unit.

The First Line of Defence is represented by employees of the Exchange’s business and operational units, whose key functions are to identify, assess and manage the risks inherent in MOEX’s daily activities, and to develop and implement policies and procedures governing existing business processes.

The Second Line of Defence is represented by the Operational Risk, Informational Security and Business Continuity Department, the Internal Control and Compliance Department, Internal Control Service, Security Department and Legal Department as well as certain employees and divisions of the Financial Division, which carry out continuous risk monitoring and management within their function, including but not limited to risk management in the following areas:

- ensuring information security, including protecting the Exchange’s interests in the information sphere;

- compliance with legislation, as well as the Exchange’s own constituent and internal documents;

- preventing the Exchange and its employees from being involved in unlawful and unethical activities, including money laundering, terrorist financing and corrupt practices;

- preventing unlawful use of insider information and/or market manipulation;

- preventing conflicts of interests, including by identifying and monitoring conflicts of interests and preventing the consequences of conflicts of interests.

These units support the First Line of Defence in identifying compliance risks, developing and embedding control procedures, interpreting applicable legislation, and preparing reports for MOEX’s governing bodies based on the results of monitoring.

The Third Line of Defence is represented by the Internal Audit Service, which monitors the efficiency and productivity of the Exchange’s financial and economic activities, the efficiency of asset and liability management, including the safety of assets and the efficiency of the market operator’s risk management. The Exchange’s governing bodies set the terms of reference for internal control systems related to risk management.